Facts About Financial Advisors Illinois Revealed

The Ultimate Guide To Financial Advisors Illinois

Table of ContentsExamine This Report about Financial Advisors IllinoisAll about Financial Advisors IllinoisAn Unbiased View of Financial Advisors IllinoisThe 5-Second Trick For Financial Advisors IllinoisHow Financial Advisors Illinois can Save You Time, Stress, and Money.Financial Advisors Illinois Can Be Fun For EveryoneOur Financial Advisors Illinois IdeasEverything about Financial Advisors IllinoisThe 7-Second Trick For Financial Advisors Illinois

Check out the consultants' profiles, have an initial phone call on the phone or intro in person, and choose who to function with. Locate Your Advisor Financial advisors help their customers develop a strategy for reaching their economic objectives.A financial expert might hold different certifications, which can confirm to their expertise, abilities and experience. A licensed investment expert (RIA), on the other hand, is mainly concerned with supplying advice concerning investments.

For their services, monetary consultants are paid a fee, normally around 1% of possessions managed each year. Some consultants are fee-only, implying they just bill fees for the services they give. Others are fee-based, indicating they accumulate fees based on the items or solutions they recommend. Either kind of monetary advisor may be a fiduciary, suggesting that they're obliged to act in the very best passions of their customers in all times.

The 2-Minute Rule for Financial Advisors Illinois

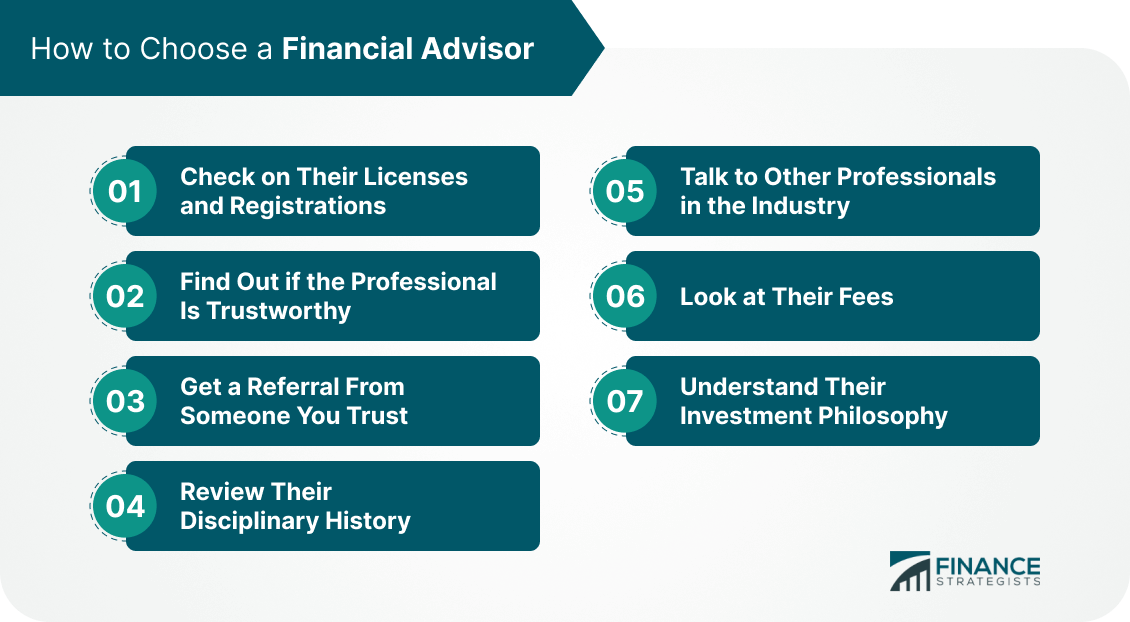

There are some hints that can make it less complicated to separate the good from the poor. Right here are nine characteristics to think about in your search for an economic consultant: If you're dealing with a financial advisor, it's likely since you're relying upon their proficiency to assist you develop a workable prepare for handling your cash.

If you're asking basic inquiries about fees, communication design or an expert's record and are met dirty answersor none at allthat's an indication that you might intend to look elsewhere for recommendations. A good monetary expert prioritizes communication with their clients. When vetting advisors, it's handy to ask how usually you can expect them to get in touch, what their favored methods of interaction are and who you can most likely to with inquiries if they're inaccessible.

Fiduciary advisors are held to a higher ethical criterion with regard to just how they recommend their customers. If you're unsure whether an advisor is a fiduciary, you can ask directly and after that validate their standing with BrokerCheck. Advisors are more than simply the items they recommend or the services they offer.

How Financial Advisors Illinois can Save You Time, Stress, and Money.

It's additionally essential for an advisor's personality to fit together well with your own. If you're an introvert, for example, you may locate handling an exceptionally extroverted advisor tough. Extroverts, on the various other hand, may locate a withdrawn advisor too booked for their tastes. The finest monetary advisors let their credibility do the talking for them.

An easy method to evaluate a consultant's credibility is to ask. Good financial experts understand that it's people, not earnings, that matter most.

Preparing a clear set of inquiries prior to you take a seat with an expert can make the process much easier and assist you find red flags. Inquiring about history and experience is a good location to begin. Figure out how much time they have actually operated in the industry, what designations they hold and what kind of customers they normally serve.

Our Financial Advisors Illinois Diaries

Some consultants bill a flat cost, others expense on a per hour basis and lots of charge a portion of properties under monitoring. Make certain you recognize precisely how they get paid and what solutions are covered under their cost.

What makes a great monetary expert? It isn't just one point; rather, there are various qualities that a great monetary consultant can possess.

You can ask them concerning their history and credentials, their fee structure, their financial investment style and the kind of clients they generally function with. Discovering an economic consultant likewise does not need to be difficult.

Check out the experts' profiles, have an initial call on the phone or intro in person, and choose that to work with. Find Your Consultant Financial experts aid their clients develop a plan for reaching their monetary objectives.

The 3-Minute Rule for Financial Advisors Illinois

In exchange for their services, monetary advisors are paid a cost, generally around 1% of assets managed per year. Either kind of financial expert may be a fiduciary, indicating that they're obliged to act in the finest interests of their clients at all times.

There are some ideas that can make it easier to divide the excellent from the negative. Right here are 9 traits to consider in your look for a monetary advisor: If you're functioning with a monetary expert, it's most likely since you're counting on their experience to assist you develop a workable prepare for managing your money.

If you're asking basic concerns concerning charges, communication style or an advisor's performance history and are fulfilled with dirty answersor none at allthat's a sign that you may want to look somewhere else for advice. A good financial expert prioritizes communication with their clients. When vetting advisors, it's handy to ask how frequently you can anticipate them to contact us, what their favored methods of communication are and who you can go to with concerns if they're inaccessible.

Fiduciary advisors are held to a higher honest criterion when it come to just how they advise their customers. If you're not sure whether an expert is a fiduciary, you can ask them straight and then verify their status through BrokerCheck. Advisors are a lot more than just the products they recommend or the services they use.

Indicators on Financial Advisors Illinois You Should Know

A simple method to determine an expert's online reputation is to ask. Good monetary experts recognize that it's people, not profits, that issue most.

Preparing a clear set of questions before you take a seat with an advisor can make the process easier and assist you detect warnings. Inquiring about background and experience is a great location to begin. Discover out the length of time they have operated in the market, what classifications they hold and what kind of clients they great post to read generally serve.

The Ultimate Guide To Financial Advisors Illinois

What makes a great financial consultant? It isn't just one point; rather, there are numerous attributes that an excellent monetary advisor can have.

For their services, monetary advisors are paid a cost, generally around 1% of properties managed annually. Some experts are fee-only, implying they just bill costs for the services they provide. Others are fee-based, suggesting they collect charges based upon the services or products they advise. Either type of economic advisor may be a fiduciary, suggesting that they're obliged to act in the very best interests of their clients in all times.

There are some clues that can make it easier to separate the excellent from the poor. Right here are nine attributes to think about in your search for a monetary expert: If you're dealing with a monetary advisor, it's most likely because you're depending on their proficiency to help you create a workable prepare for managing your money.

Getting My Financial Advisors Illinois To Work

If you're asking basic questions about charges, communication style or a consultant's record and are consulted with murky answersor none at allthat's a sign that you might want to look in other places for suggestions. A great monetary advisor prioritizes interaction with their customers. When vetting experts, it's useful to ask just how often you can anticipate them to get in touch, what their chosen methods of interaction are and who you can go to with questions if they're inaccessible.

Fiduciary consultants are held to a greater honest standard when it come to exactly how they recommend their check my reference clients. If you're not sure whether or not a consultant is a fiduciary, you can ask straight and afterwards validate their standing through BrokerCheck. Advisors are greater than simply the items they recommend or the solutions they supply.

It's additionally important for an expert's personality to mesh well with your own. If you're an autist, as an example, you might find taking care of a very extroverted consultant tough. Exhibitionists, on the various other hand, may discover an introverted expert too scheduled for their preferences. The ideal financial experts let their reputation do the talking for them.

10 Easy Facts About Financial Advisors Illinois Shown

A simple means to evaluate a consultant's track record is to ask. Great monetary advisors understand that it's people, not profits, that issue most.

Preparing a clear set of questions before you take a seat with an advisor can make the procedure less complicated and help you detect red flags. Inquiring about background and experience is a great location to start. Discover for how long they have operated in the industry, what classifications they hold and what kind of customers they generally serve.

Some consultants bill a level cost, others costs on a hourly basis and numerous bill a percentage of assets under monitoring. Make sure you recognize exactly how they obtain paid and what services are covered under their charge.

Having that dedication in composing provides you added protection as a client - Financial Advisors Illinois. Confirming their response with your very own research utilizing devices like FINRA BrokerCheck can verify that the consultant is both qualified and trustworthy. What makes a great economic expert? It isn't just one point; instead, there are numerous characteristics that a good economic consultant can have.